SDK Receipt Compliance Requirements

SDK Compliance for Remittance Transfer Rule

The Remittance Transfer Rule requires providers to give senders disclosures at various stages of the transfer process. For example, this rule requires a remittance transfer provider to give a prepayment disclosure to the sender before the payment of a remittance transfer. (Pre-Payment Disclosures,12 CFR 1005.31(b)(1) and (12 CFR 1005.31(e)(1))

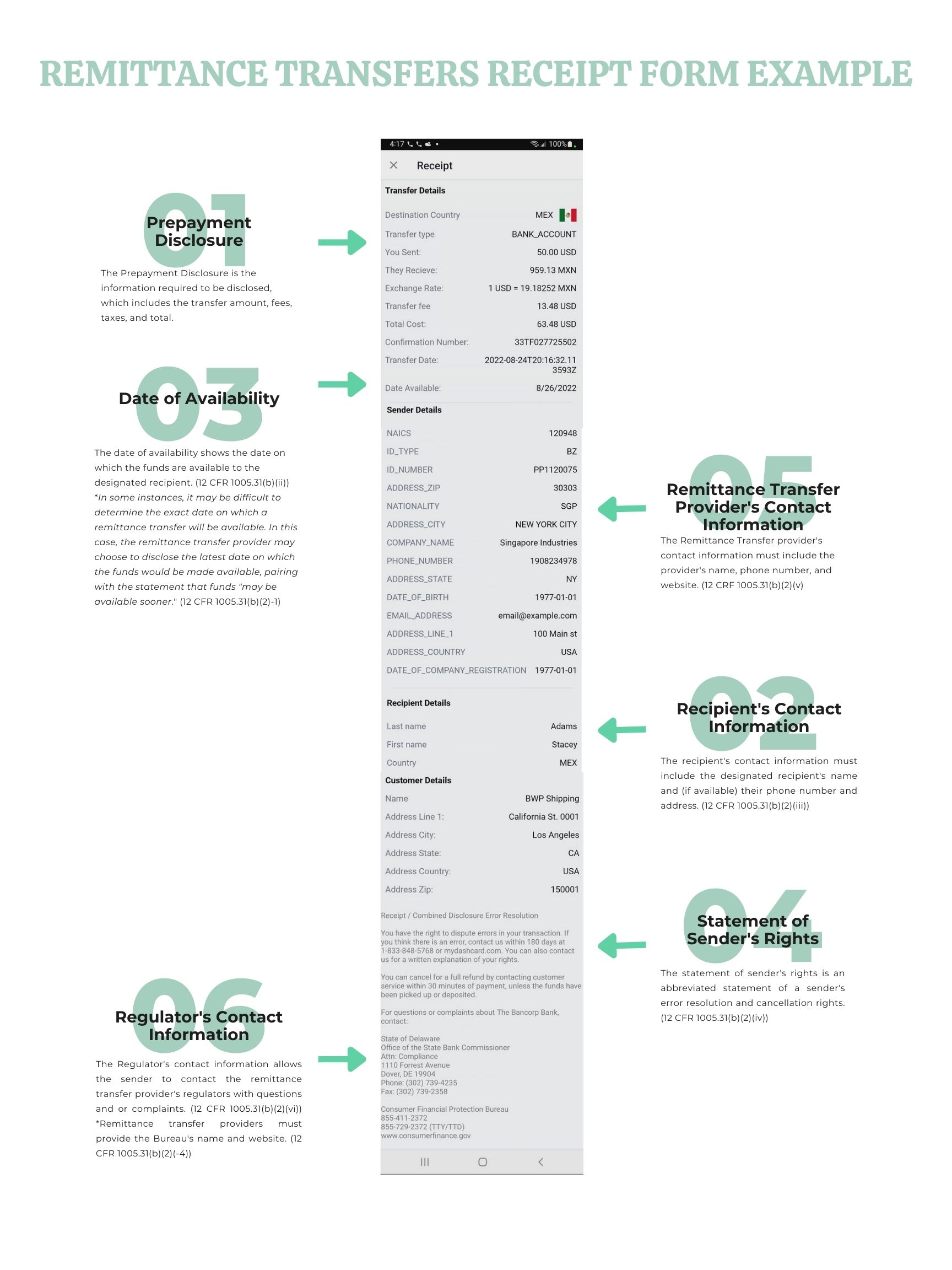

Additionally, the remittance transfer provider must provide a receipt to the sender after payment is made. This receipt must contain the following five sections: the Recipient’s Contact Information, Date of availability, Statement of Sender’s Rights, Remittance Transfer Provider’s Contact Information, and Regulator’s Contact Information.

NOTETo comply with these regulations, you must code your receipts into your SDK

Section Explanation

This receipt must contain the following five sections: the Recipient’s Contact Information, Date of availability, Statement of Sender’s Rights, Remittance Transfer Provider’s Contact Information, and Regulator’s Contact Information. The numbers below correlate with the numbers next to their appropriate sections within our example receipt.

1. Pre-Payment Disclosure

The Prepayment Disclosure is the information required to be disclosed, including the Transfer amount, fees, taxes, and total.

Example of Pre-Payment Disclosure:

| Name | Amount |

|---|---|

| Transfer Amount | $700.00 |

| Transfer Fees | $14.00 |

| Transfer Taxes | $6.00 |

| Total | $720.00 |

2. Recipient’s Contact Information

The recipient's contact information must include the designated recipient's name and (if available) their phone number and address. (12 CFR 1005.31(b)(2)(iii))

Example of Recipient’s Contact Information:

Recipient:

Name: John Doe

Address: 3333 Nonreal St., Albuquerque, New Mexico XXXXX

Phone: 000-000-0000

3. Date of availability

The availability date shows the date on which the funds are available to the designated recipient. (12 CFR 1005.31(b)(ii))

*In some instances, it may be difficult to determine the exact date on which a remittance transfer will be available. In this case, the remittance transfer provider may choose to disclose the latest date on which the funds would be made available, pairing with the statement that funds "may be available sooner." (12 CFR 1005.31(b)(2)-1)

Example of Date Available:

October 27, 2022

4. Statement of Sender’s Rights

The statement of sender's rights is an abbreviated statement of a sender's error resolution and cancellation rights. (12 CFR 1005.31(b)(2)(iv))

Example of Sender’s Rights:

“You have the right to dispute errors in your transaction. If you think there is an error, contact us within 190 days at 000-000-0000 or www.ourcompany.com. You can also contact us for a written explanation of your rights.

You can cancel for a full refund within 30 minutes of payment unless the funds have been picked up or deposited.”

5. Remittance Transfer Provider’s Contact Information

The remittance transfer provider's contact information must include the provider's name, phone number, and website. (12 CRF 1005.31(b)(2)(v)

Example of Provider’s Contact Information:

Remittance Transfer Company’s Name: Best Remittance Company

Remittance Transfer Company’s Address:

32323 Nonreal St., Albuquerque, New Mexico XXXXX

Remittance Transfer Company’s Phone: 000-000-0000

OR

Best Remittance Company

32323 Nonreal St., Albuquerque,

New Mexico XXXXX

000-000-0000

6. Regulator’s Contact Information

The Regulator's contact information allows the sender to contact the remittance transfer provider's regulators with questions or complaints. (12 CFR 1005.31(b)(2)(vi)) *Remittance transfer providers must provide the Bureau's name and website. (12 CFR 1005.31(b)(2)(-4))

Example of Regulator’s Contact Information:

Name: State Regulatory Agency

Phone: 000-000-0000

Website: www.stateregulatoryagency.gov

Receipt Example

An example ReadyRemit receipt can be seen here.

For more information on the Consumer Financial Protection Bureau’s Requirements of Remittance Transfers, please see section 12 CFR 1005.31.

Updated 6 months ago