Choose your Integration

Identify which integration type is right for your use case.

With ReadyRemit you'll be able to integrate cross-border disbursement or remittance in a matter of weeks. This guide will help you get started by identifying your integration type and choosing the right integration guide. If you have any questions, please <a href="https://developer.readyremit.com/docs/contact-us" target="_blank" style={{ color: "#42CB91" }}>get in touch with the ReadyRemit Integrations Team.

1. Business vs Consumer Senders

The first question you will need to answer is whether the ReadyRemit <<glossary:Transfer>> will be classified as Business-to-Consumer (B2C) or Consumer-to-Consumer (C2C) transactions. The key differentiator between these use cases is the source of the funds.

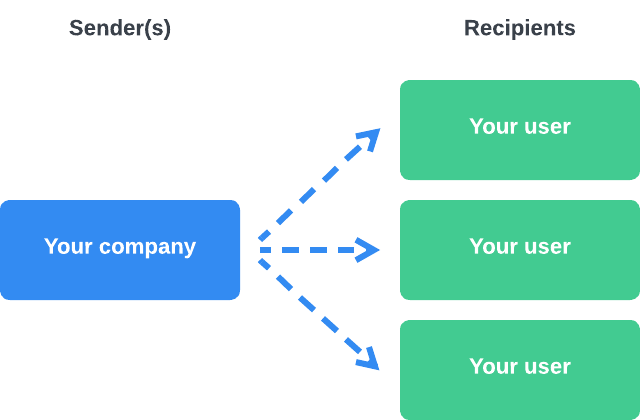

In the Business to Consumer (or B2C) use case, funds originate from your company's account and are disbursed to your end-users. In this case the <<glossary:Sender>> entity in ReadyRemit is your company and the <<glossary:Recipient>> entities in are your users.

Business-to-Consumer (B2C)

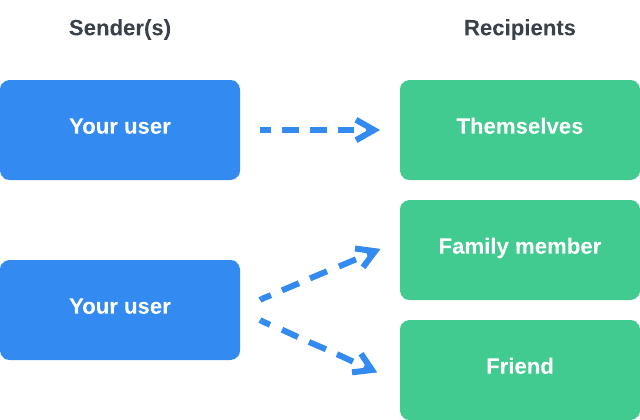

In the Consumer to Consumer (or C2C) use case, funds originate with your end users and are sent to either themselves or a friend or family member. In this case the <<glossary:Sender>> entity in ReadyRemit is your user and the <<glossary:Recipient>> entities represent the user sending money to themselves or another person.

Consumer to Consumer (C2C)

Based on your identified transfer type, certain compliance requirements / integration points are required.

| Business-to-Consumer (B2C) | Consumer-to-Consumer (C2C) | |

|---|---|---|

| SDK capable | No | Yes |

| Sender KYC required | No | Yes |

| Sender ID(s) | Provided by the ReadyRemit Integrations Team | Created by you for each of your users |

2. API vs SDK

B2C

If your identified transfer type is B2C, only API integrations are supported.

In an SDK integration, several API endpoints are still required for integration from your server but the ReadyRemit SDK handles 90% of the transfer flow. This type of integration can dramatically reduce time-to-market. Some requirements to be eligible for an SDK integration:

- Your transfer types will be classified as consumer-to-consumer (C2C).

- You provide your users a mobile application and or web application where the ReadyRemit SDK can be initiated.

- You don't require any changes to the remittance flow other than cosmetic.

If an SDK integration isn't possible, an API-only integration will give you complete control over the remittance flow for your users.

Updated 6 months ago

Based on your answers to the above items, you can begin integrating with ReadyRemit today using one of the following integration guides: